About

PIEX MEETS A REAL NEED: IMPROVING ACCESS TO HEALTH AND WELLNESS PRODUCTS IN AFRICA

Founded in 1979 by Robert Jamain, Pharmaceutique d’Import Export – PIEX – was acquired in July 2017 as part of a project led by Bertrand Talbotier and supported by a group of investors led by LBO France. PIEX has since expanded very rapidly through organic growth and an initial external growth with the acquisition of PharmaCDI, also a distribution player in West Africa.

In 2023, the acquiring of Apexfarma and its subsidiary Cross Pharm will strengthen PIEX Group’s value chain in the implementation of synergies between the historical distribution activity and turnkey export services.

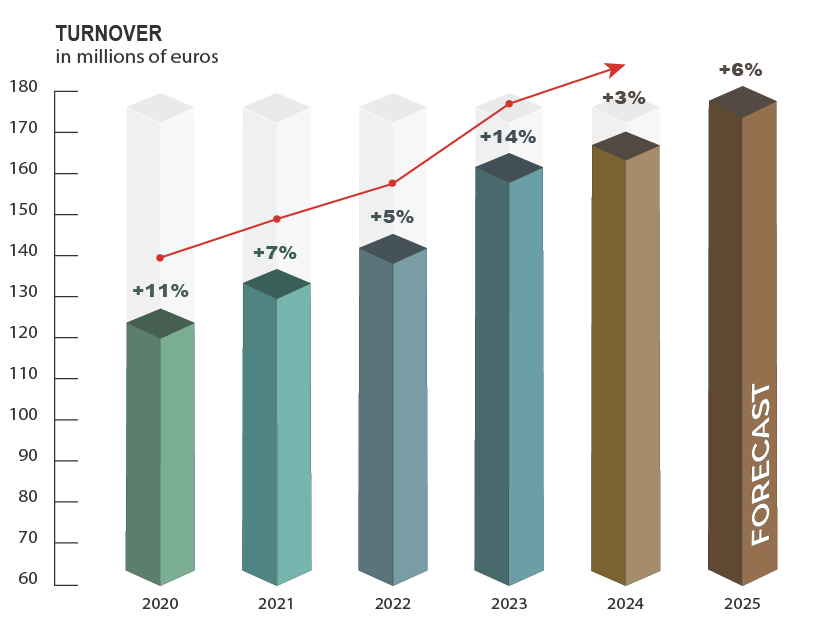

Key Figures

THE EVOLUTION OF PIEX SHOWS AN UNINTERRUPTED GROWTH OF ITS MARKET SHARE ON THE AFRICAN CONTINENT

Logistics in Figures

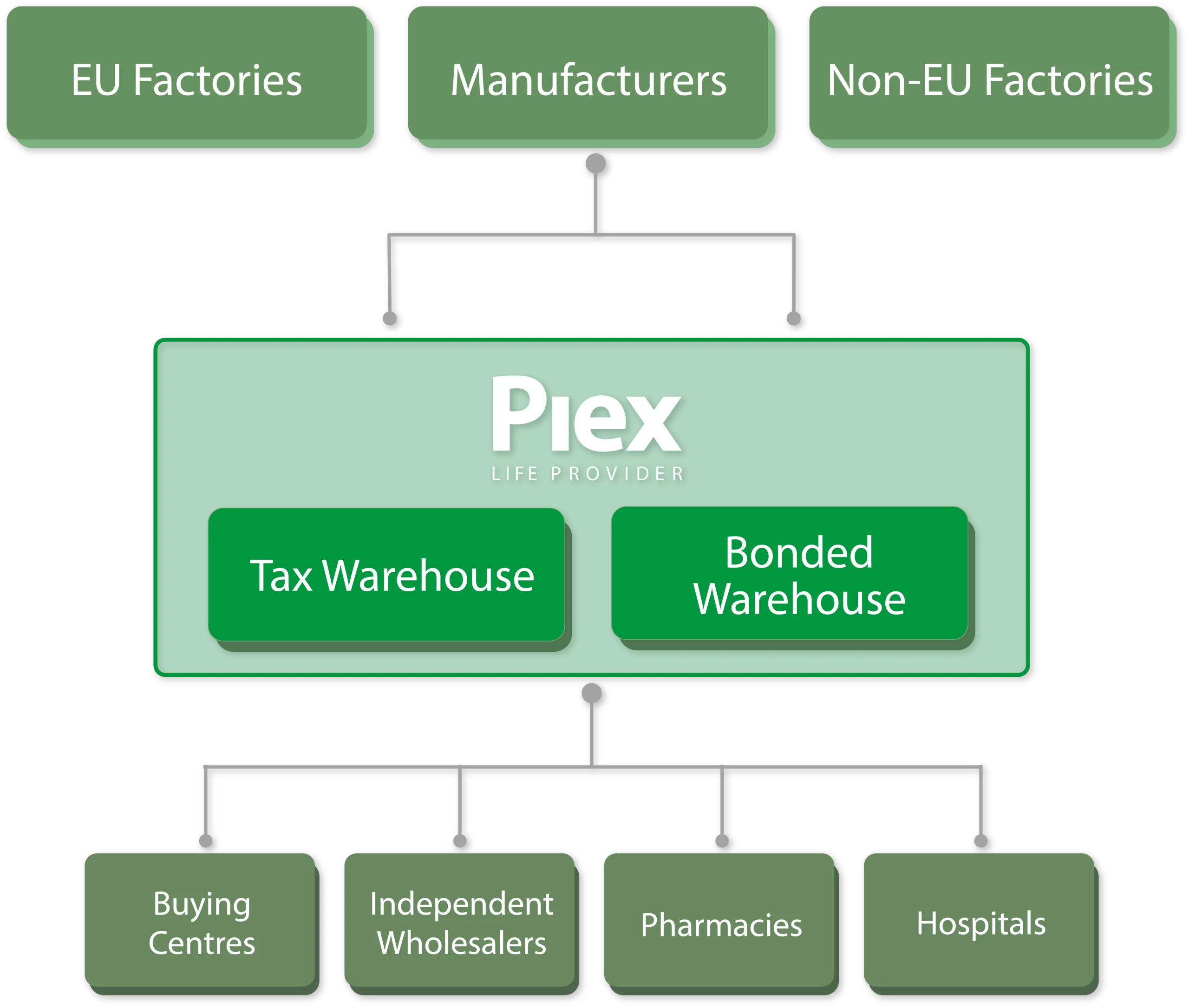

PIEX IS EXTREMELY VIGILANT ABOUT THE EFFICIENCY OF ITS INFRASTRUCTURE AND THE EFFECTIVENESS OF ITS LOGISTICS

(DELIVERED PER YEAR)

(IN PALLETS)

(PER YEAR)

(PER YEAR)

Marketing and Regulatory in Figures

PIEX SUPPORTS ITS PARTNERS AND CLIENTS WORLDWIDE AND IN AFRICA

The Team

A NEW MANAGEMENT TEAM ARRIVED IN 2017: EXPERTISE AND COMMITMENT TO HEALTH IN AFRICA.

A new management team has been in charge since July 2017.

Dynamism, service and expertise are at the heart of the new strategy: to bring PIEX to the forefront in the distribution of pharmaceutical and healthcare products, mainly in Africa.

Diane

DEBROUSSE

Director of Regulatory Affairs and Quality

Anne

CONSIGNY

Interim Head Pharmacist

Émilie

PORTIER

Accounts Receivable

Juliette

DEROCHE

Warehouse Management System Engineer

Séverine

GENEST

Accounts Payable

In the context of the evolution of the company founded by Robert Jamain, the management team of PIEX Group and its partners aim to make PIEX one of the leading distributors of healthcare products on the African continent.

Solid financial partners were needed, able to grasp the challenges of the continent, to accompany it in its ambitious development projects, and to support the Group in a determined growth strategy.

Financial Partners & Shareholders

PIEX WAS ABLE TO CONVINCE SOLID AND SERIOUS PARTNERS, ABLE TO UNDERSTAND THE STAKES

Shareholders

LBO FRANCE

Pioneer and major player in private equity for over 30 years in France.

AFRIC INVEST

Africinvest is an investment and financial services company specialized in the African continent.

BPI FRANCE

The French State Bank that supports the growth and internationalization of French companies.

BNP PARIBAS DÉVELOPPEMENT

Equity investments to support the development of SMEs and SMIs.

TROCADERO CAPITAL PARTNERS

Trocadero CP supports investment funds and managers.